Aurélie Clementz

Partner | Legal

Luxembourg Legal Services

Aurélie Clementz

Partner

Luxembourg Legal Services

Big things are happening at Ogier. Change is embedded in everything we do. It is redefining our talent, our ways of working, our platforms of delivery, our culture.

Services

We have the expertise to handle the most demanding transactions. Our commercial understanding and experience of working with leading financial institutions, professional advisers and regulatory bodies means we add real value to clients’ businesses.

Sectors

Our sector approach relies on smart collaboration between teams who have a deep understanding of related businesses and industry dynamics. The specific combination of our highly informed experts helps our clients to see around corners.

We have the expertise to handle the most demanding transactions. Our commercial understanding and experience of working with leading financial institutions, professional advisers and regulatory bodies means we add real value to clients’ businesses.

Legal

Corporate and Fiduciary

Consulting

Banking and Finance

Corporate

Dispute Resolution

Employment law

Intellectual Property

Investment Funds

Listing services

Local Legal Services

Private Wealth

Property law

Regulatory

Restructuring and Insolvency

Tax

Banking and Finance overview

Asset Finance

CAYLUX Fund Finance

Debt Capital Markets

Derivatives

Fund Finance

Islamic Finance

Leveraged Finance

Listing services

Real Estate Finance

Regulatory

Restructuring and Insolvency

Structured Finance

Sustainable Finance

Corporate overview

Economic Substance

EIIS Services in Ireland

Equity Capital Markets

Insurance and Reinsurance

Listing services

Mergers and Acquisitions

Private Equity

Real Estate Structuring, Acquisitions and Disposals

Regulatory

Technology and Web3

Dispute Resolution overview

Banking Disputes

Corporate and Financial Services Disputes

Crypto Disputes

Enforcement of Judgments and Awards

Fraud and Asset Tracing

Funds Disputes

Insurance Disputes

International Arbitration

Regulatory

Restructuring and Insolvency

Section 238 Shareholder Appraisal Rights

Shareholder and Valuation Disputes

Trusts Disputes and Applications

Investment Funds overview

Hedge Funds

Managers and Sponsors

Private Equity

Real Estate, Infrastructure and Energy Funds

Regulatory

Sustainable Investing and Impact Funds

Technology and Web3

Local Legal Services overview

Cayman Local Legal Services

Channel Islands Local Legal Services

Ireland Local Legal Services

Employment law

Estate Planning, Wills and Probate

Expat services

Family Office

Intellectual Property

Make your Guernsey will online

Make your Jersey lasting power of attorney online

Make your Jersey will online

Notary public services

Relocating your business

Relocating your family

Property law

Accounting and Financial Reporting Services - Ogier Global

Cayman Islands AML/CFT training - Ogier Global

Corporate Services - Ogier Global

Debt Capital Markets - Ogier Global

Fund Services - Ogier Global

Governance Services - Ogier Global

Investor Services - Ogier Global

Ogier Connect - Ogier Global

Private Wealth Services - Ogier Global

Real Estate Services - Ogier Global

Regulatory and Compliance Services - Ogier Global

Our sector approach relies on smart collaboration between teams who have a deep understanding of related businesses and industry dynamics. The specific combination of our highly informed experts helps our clients to see around corners.

Ogier provides practical advice on BVI, Cayman Islands, Guernsey, Irish, Jersey and Luxembourg law through our global network of offices across the Asian, Caribbean and European timezones. Ogier is the only firm to advise on this unique combination of laws.

Keep up to date with industry insights, analysis and reviews. Find out about the work of our expert teams and subscribe to receive our newsletters straight to your inbox.

Fresh thinking, sharper opinion.

We get straight to the point, managing complexity to get to the essentials. Our global network of offices covers every time zone.

No Content Set

Exception:

Website.Models.ViewModels.Components.General.Banners.BannerComponentVm

Insight

06 January 2023

Luxembourg Corporate Services, Luxembourg Legal Services

1 min read

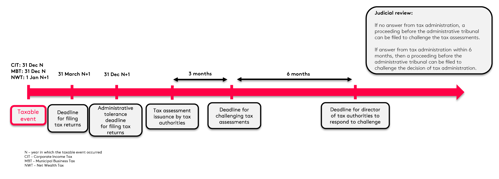

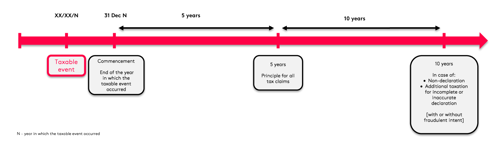

Outstanding tax debts are, in principle, subject to forced collection by the Luxembourg tax authorities. Recovery procedures involve several phases and commencement is directly or indirectly linked to the occurrence of the taxable event.

Below we summarise the main deadlines relevant in Luxembourg tax filings and litigation proceedings, applicable statutes of limitations, as well as the key steps of forced collection (based on the taxpayer's country of residence).

Aurélie Clementz

Partner | Legal

Luxembourg Legal Services

Aurélie Clementz

Partner

Luxembourg Legal Services

Contact Aurélie

Back

Hadrien Brémon

Counsel | Legal

Luxembourg Legal Services

Hadrien Brémon

Counsel

Luxembourg Legal Services

Contact Hadrien

Back

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up

No Content Set

Exception:

Website.Models.ViewModels.Blocks.SiteBlocks.CookiePolicySiteBlockVm