James Philpott

Associate Director | Corporate and Fiduciary

Jersey

James Philpott

Associate Director

Jersey

Despite renewed optimism in real estate boardrooms, capital availability and deal financing remain challenging as we head into 2026. This article explores the high-level trends shaping decision-making in the real asset space, highlighting the key issues and opportunities fund managers are navigating in today’s market.

There's been optimism, of varying forms, apparent in the real estate investment industry all year. Structuring experts are speaking of a noticeable H2 2025 uptick in new deal enquiries and lawyers are describing a similar story. Both good examples of what to expect in 2026 for fund administrators operating in the real asset space. But devising the structuring and legal framework for an exciting new deal is one thing, securing the capital, financing and executing is another.

Market recovery optimism is being tempered by the well documented headwinds most had hoped would have disappeared, or at least materially subsided, by the final quarter of 2025. The cost of debt, inflation, repeated shocks from around the global macroeconomic environment and capital raising difficulties continue to cause market nervousness. Lots of investor powder continues to be kept dry, with managers holding out for better economic conditions. But when will these conditions improve to the level required for investment committees to begin pulling the trigger on deals?

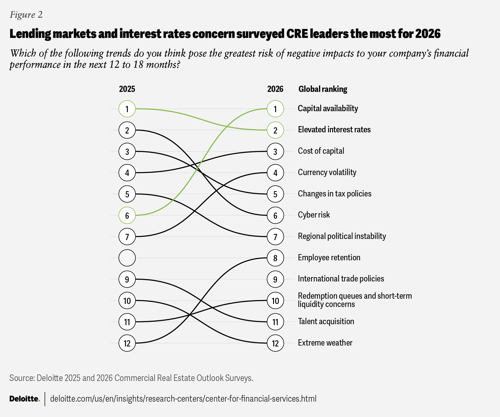

Deloitte's recently published 2026 commercial real estate outlook, asked its survey respondents to rank the most significant risks to financial performance of their real asset businesses. The results make for interesting, but perhaps unsurprising, reading. Capital availability, elevated interest rates and the cost of capital topping the charts - with capital availability jumping dramatically into 2026 – 20% of Deloitte's Asia-Pacific respondents foresee worsening capital availability into next year.

The capital availability concerns of the Deloitte survey respondents align with what we continue to hear in the boardroom. Capital does appear to be available to managers brokering deals for assets with strong fundamentals, but while the 'green shoots' of recovery are beginning to surface for the best in class, the capital drought does appear set to continue into 2026 for the majority.

Based on deal visibility at Ogier, development project investment through forward funding arrangements had long been a popular form of deal financing in the UK. Fixed price forward funding contracts – where the developer generally bears the delivery risk – offered attractive returns to investors in living sector space in particular.

Under these contracts, investors agree to acquire the completed asset at a pre-agreed price, with developers typically managing their risk exposure through a fixed-price standard JCT design and build contract, and strong contractor guarantees. An attractive form of development finance for all involved when economic risks can be well managed by the developer, and when there is cost stability of materials and labour.

However, stability in these areas has been absent in recent years. The effects of the Covid-19 pandemic, followed quickly by the effects of conflict in Ukraine and the Middle East are well documented. Supply chain disruption, energy price shocks, access to raw materials, labour shortages and wage inflation and regulatory changes, to name but a few, have all contributed to instability within construction markets. The result is that developers have become unable to manage previously manageable risks and, in turn, this risk and reward imbalance has led to the dwindling of fixed price forward funding financing deals.

Until delivery risk and pricing volatility begin to settle toward more acceptable ranges for investors and developers, fixed price forward funding looks likely to remain a marginal tool, rather than the mainstream engine of development financing it once was.

According to the UK's Building Cost Information Service's (the BCIS) forecasts, while construction inflation is expected to continue to rise over the next five years, the annual rate of construction inflation growth has slowed significantly from recent peaks. This deceleration of build cost inflation may translate into the re-emergence of the fixed price forward funding structure but, for now, the market is adapting.

Hybrid forward funding models, where cost-sharing mechanisms in the contract attempt to re-calibrate the risk exposure to both the investor and developer, are beginning to fill the void. Typically, under these arrangements, the pre-agreed headline price is supported by index-linked adjustments (often tied back to BCIS indices), providing developers with a layer of protection against further construction inflation.

With forward funding waiting patiently in the wings, investors are being pushed higher up the capital stack to find alternative sources of deal funding. Private credit real estate funds have been deployed to fill some of this void left behind by traditional bank debt and forward funding arrangement in the real estate development market.

Unitranche structures continue to dominate the private debt market, with mezzanine loans increasingly sidelined, according to Deloitte's Private Debt Deal Tracker Europe August 2025 report. But as better 2025 data is becoming more readily available, readers of this Deloitte report will see that continued volatility in the interest rate and foreign exchange markets have continued to plague 2025, with trade tariff uncertainty flowing out of policy makers in the United States largely attributed to foreign exchange challenges across European currencies. The result - fewer European private debt deals launched in H1 2025 versus H2 2024.

![]()

Deal count alone, however, tells only part of the wider market story. Some of industry’s largest and most highly rated participants, especially US-headquartered firms, are continuing to expand their private credit real estate fund platforms. US real estate giant Greystar's October 2025 press release, for example, announced the final close of their newest credit opportunities fund platform exceeding the original $750 million target with $1.27 billion. They're not alone. Some of the industry's biggest household names are pursuing similar growth strategies in the opportunistic private debt space. As macroeconomic conditions begin to stabilise, those on the European continent will be hoping to replicate this growth in the real estate private debt space in 2026 and beyond.

For now, based on our transaction visibility in 2025, joint venture fund arrangements continue to lead the charge in the UK real estate investment space. From a structuring perspective, Jersey continues to be well positioned to support joint venture fund, feeder and co-invest arrangements – particularly in light of the significant enhancements made to Jersey's Private Fund regime earlier this year.

Ogier Global, Ogier's corporate and fiduciary services division, offers borderless corporate and fund administration services from our international finance hubs across the globe, covering all time zones.

Our deep asset specific knowledge and expertise are underpinned by our legal practice, which has been advising fund managers and advisory firms in the real asset space for decades.

Ogier Global’s fund administration teams are positioned to leverage our employees' strengths. We have dedicated teams for fund administration, financial reporting, compliance, governance, and financial systems. Our experienced teams work with fund managers globally, providing industry insights, truly understanding the asset class, and using top-notch technology.

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up