Tervinder Chal

Managing Director, Singapore | Corporate and Fiduciary

Singapore

Tervinder Chal

Managing Director, Singapore

Singapore

No Content Set

Exception:

Website.Models.ViewModels.Components.General.Banners.BannerComponentVm

Investment funds and fund management businesses in Singapore are subject to tax. The Singapore government offers tax exemptions and other incentives to enhance and develop its financial services industry. There are incentives available at business level, such as for fund managers, and tax incentives at the investment fund vehicles.

Though these are tax incentives, they are offered and monitored by the Monetary Authority of Singapore and not the Inland Revenue Authority of Singapore.

The financial services incentives for fund managers (FSI-FM) incentive allows for fee income earned from qualifying fund is taxed at a concessionary tax rate of 10% instead of corporate tax rate of 17%. This incentive is available for a period of five years and offered to fund managers that would meet the following conditions:

The fund manager must be a CMS licence holder or legally exempted from obtaining CMS licence

The fund manager must have employed three investment professionals in Singapore

The fund manager must manage a minimum of SGD 250Million of assets

It would be also pertinent to note that the MAS may also consider other factors such as headcount, AUM projections, business spending etc. when considering the grant application.

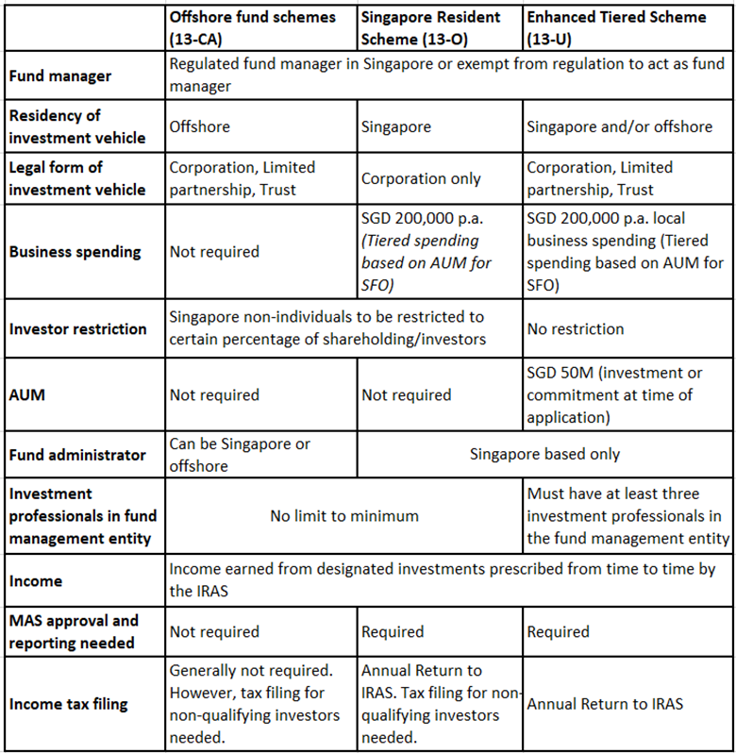

There are three exemptions available for investment funds that are managed by Singapore based fund managers. The “specified income” which are derived from specified investments (designated investments) are exempt from tax.

Singapore resident fund scheme is offered to fund managers that manage a fund domiciled in Singapore and must meet the following conditions:

The fund must be managed by a licensed, registered or a manager that is exempted from licensing/registration in Singapore.

The fund vehicle must be a Singapore corporate entity (including VCC) and must be a tax resident

Income earned (including capital gains) by such vehicle must be from designated investments that are prescribed by the Inland Revenue Authority of Singapore (IRAS) from time to time.

The fund must not have more than a certain percentage of Singapore non-individuals as shareholders/investors of the fund vehicle

The fund must spend SGD 200,000 per annum*

The fund administrator must be Singapore based.

The investment strategy must be approved by the MAS as part of the incentive application process

The fund manager must report to investors annually as well as file annual returns to the IRAS. Annual declaration to MAS is required

*Single family offices have tiered spending requirement based on the assets under management.

The Enhanced Tiered fund scheme is offered to fund managers that manage a fund domiciled in Singapore or offshore or a combination of the on-shore/off-shore in the master-feeder structure or SPVs held by the fund and must meet the following conditions:

The fund must be managed by a licensed, registered or a manager that is exempted from licensing/registration in Singapore. The fund manager must employ three investment professionals.

The fund vehicle can be any form of legal entity (Corporate, VCC, LP, Trust), either in Singapore or offshore

Income earned (including capital gains) by such vehicle must be from designated investments that are prescribed by the Inland Revenue Authority of Singapore (IRAS) from time to time.

The fund must have assets under management or commitment of SGD 50Million and above at the time of application.

The fund must spend SGD 200,000 per annum* in Singapore.

The fund administrator must be Singapore based.

The investment strategy must be approved by the MAS as part of the incentive application process

The fund manager must report to investors annually as well as file annual returns to the IRAS. Annual declaration to MAS is required.

*Single family offices have tiered spending requirement based on the assets under management.

The offshore fund tax scheme is specifically available to offshore funds that are managed by Singapore fund managers and must meet the following conditions:

The fund must be managed by a licensed, registered or a manager that is exempted from licensing/registration in Singapore.

The fund vehicle can be any form of legal entity (Corporate, VCC, LP, Trust), and must not be Singapore tax resident

Income earned (including capital gains) by such vehicle must be from designated investments that are prescribed by the Inland Revenue Authority of Singapore (IRAS) from time to time.

The fund must not have more than a certain percentage of Singapore non-individuals as shareholders/investors of the fund vehicle

No approval is needed from the MAS for this scheme. It is a self-reporting/declaration scheme.

The fund manager must report to investors annually. Filing of annual returns is generally not required. Annual declaration to MAS is not required.

In Singapore, goods and services tax (GST) is charged on any supply of goods or services made in Singapore by a taxable person in the course or furtherance of any business carried on by such person. The standard rate of GST is 7% (to be increased to 8% from January 2023) unless the supply qualifies for zero rating (GST applicable at 0%) or is an exempt supply.

The provision of financial services are exempt from GST. Examples of financial services that are exempt from GST include:

interest income from bank deposits or from loans;

sales of debt and equity securities; and

sales of units in unit trusts.

Under the GST Act, where a supply can be both exempt and zero rated, zero rating will prevail. An investment fund resident in Singapore, is a person subject to GST and must file for a GST registration. The businesses (fund manager) are also subject to GST but there are remissions and exemptions also available.

This article was written in partnership with a consultant. Ogier, and by extension Ogier Global, does not provide tax advice. Details of this article were correct at the time of publication. For the most up-to-date position, please refer to your tax adviser.

Tervinder Chal

Managing Director, Singapore | Corporate and Fiduciary

Singapore

Tervinder Chal

Managing Director, Singapore

Singapore

Connie Chan 陈丽芬

Associate Director 副董事 | Corporate and Fiduciary

Singapore

Connie Chan 陈丽芬

Associate Director 副董事

Singapore

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up

No Content Set

Exception:

Website.Models.ViewModels.Blocks.SiteBlocks.CookiePolicySiteBlockVm