Kasia Zatorska

Senior Manager, Sustainable Investment Consulting | Consulting

Hong Kong

Kasia Zatorska

Senior Manager, Sustainable Investment Consulting

Hong Kong

No Content Set

Exception:

Website.Models.ViewModels.Components.General.Banners.BannerComponentVm

The question of whether short selling is compatible with the spirit of responsible investing is a topic that has come under scrutiny in recent years. This article examines the different concepts used today to operationalise carbon footprinting, including the idea of netting as a tool to achieve net-zero emissions, as well as the impact that buying and selling short positions might have on the cost of capital.

We have leveraged our experience working with alternative asset managers on topics such as climate change regulation and strategy implementation in order to clarify questions related to transparency in carbon reporting and how this might be affected by potential inconsistencies in relation to "netted" disclosures. So far, limited guidance on this topic from the regulators has raised many questions with regards to disclosures and a proper evaluation of risk exposure.

From an investment standpoint, it is widely recognised that climate risk can create financial risks, stemming from physical impacts (ie floods, storms, droughts and fires) as well as the real economies needed to transition to a more sustainable use of resources. At the same time, there are numerous investment opportunities that can also be identified.

Increasing regulatory demands and growing investor pressure to manage climate risk are forcing asset managers to act. Asset managers, banks and insurance companies are being required not only to identify climate-related risks in their operations but also in their investment portfolios. Doing so transparently and in a consistent manner will hopefully help achieve the overarching goal of greenhouse gas (GHG) reduction in line with the Paris Agreement.

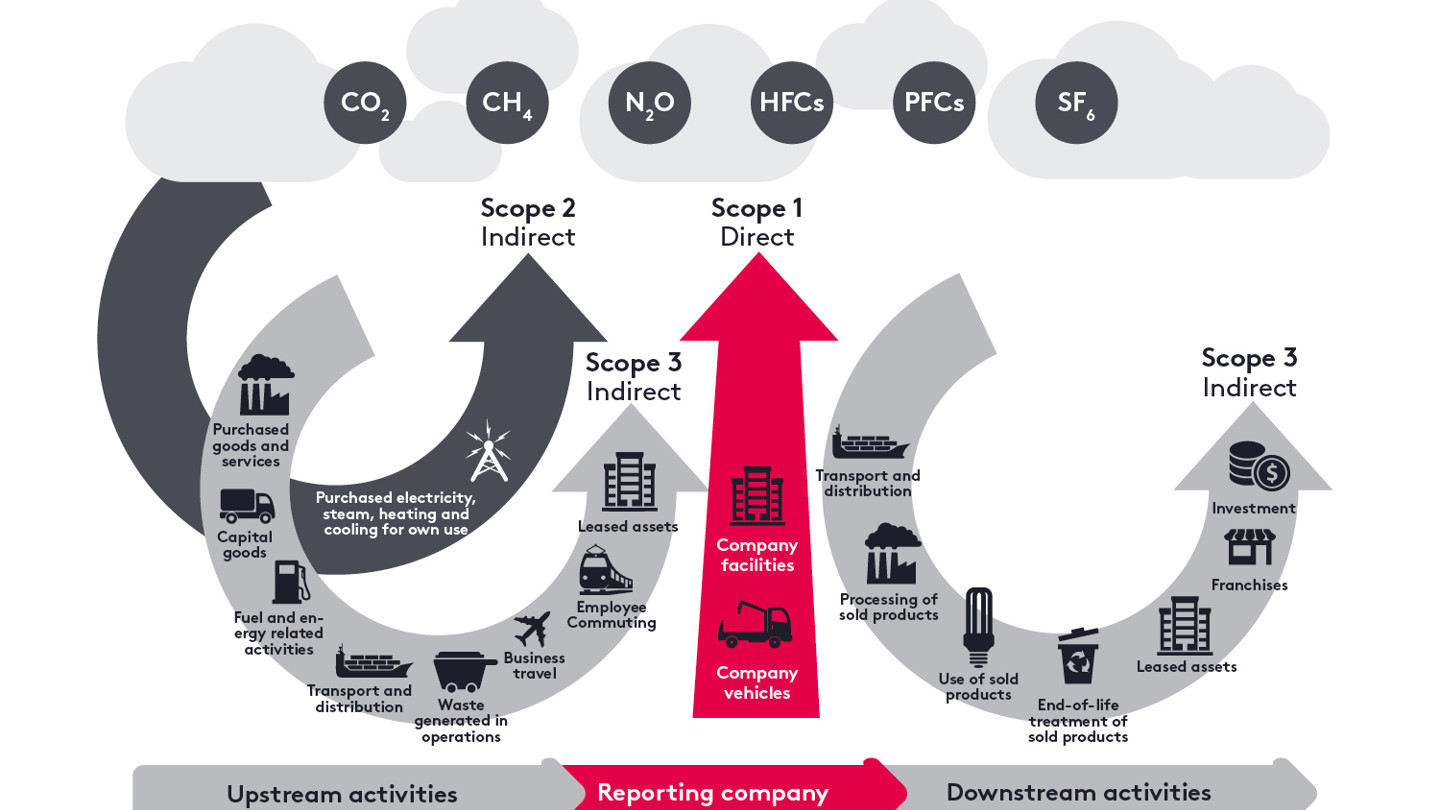

GHG accounting is the process of measuring the amount of GHG emissions produced by a company and involves the assessment of the total direct and indirect GHG emissions arising from a business' activities. To date, scope 1, scope 2 and scope 3 GHG emissions have been the most common metrics used by the finance industry, NGOs and international organisations to assess global efforts to transition to a low-carbon economy. And we except these metrics to continue to be a key tool for companies and investors to track and report on their progress of GHG emission reduction and avoidance.

The definitions and differences in these three scopes, as defined by the GHG Protocol Corporate Accounting and Reporting Standard[1], are illustrated in the figure below. They are divided into direct emissions, that are generated by sources owned or controlled by the reporting company, and indirect emissions, which occur as a consequence of the operations of the reporting company but are generated by sources owned or controlled by another company. Measuring the amount of GHG generated, avoided or removed by an entity allows for tracking, reporting and comparison of the changes in emissions over time.

For financial institutions, measuring GHG emissions can help achieve multiple goals. Firstly, it allows banks and other creditors and investors to measure and report on the GHG emissions resulting from financed activities (which is important for transparency) and to allow for goal setting and strategic action to bring about meaningful reductions, as well as to track progress.

Secondly, it is also an important step in enabling financial institutions to manage transition risks[2]. For example, as part of the climate-risk management process, portfolio managers need to be able to determine which sectors are considered high in intensity for GHG emissions and which investments carry the risk of dynamic materiality.[3] These metrics can be important for analysing whether or not to invest, whether portfolio adjustment is required and to help formulate engagement targets for investee companies.

Finally, as more businesses make net-zero emissions commitments, reaching a consensus on accurate carbon accounting is vital to achieving the collective aims of global carbon reduction.

Since the inception of the Task Force on Climate-Related Financial Disclosures (TCFD) in 2015, international investors have been calling for high quality, transparent and reliable data on climate and other environmental, social and governance (ESG) matters. The work of the International Financial Reporting Standards (IFRS) Foundation and, more specifically, that of the International Sustainability Standards Boards (ISSB), has been advancing global adoption of the overarching standard that applies to sustainability related risks and opportunities. The recently announced decision on all technical content of the initial two ISSB Standards[4], S1 – "General Requirements for Disclosure of Sustainability-related Financial information" - and S2 – "Climate related Disclosures" - has been an important milestone in building that framework, with an effective adoption date for these two Standards set for January 2024.

Other important work for achieving common guidelines in climate mitigation has been carried out by the Net Zero Investment Framework, which provides a set of recommended actions and methodologies for investors to maximise their contribution to achieving global net-zero emissions by 2050. The Institutional Investors Group on Climate Change (IIGCC), which is a European body for investor collaboration and a co-author of the Net Zero Investment Framework, has in fact been one of the first official bodies that offered analytical concepts in relation to net zero investment strategy in portfolios using derivatives.[5]

Its key observations are:

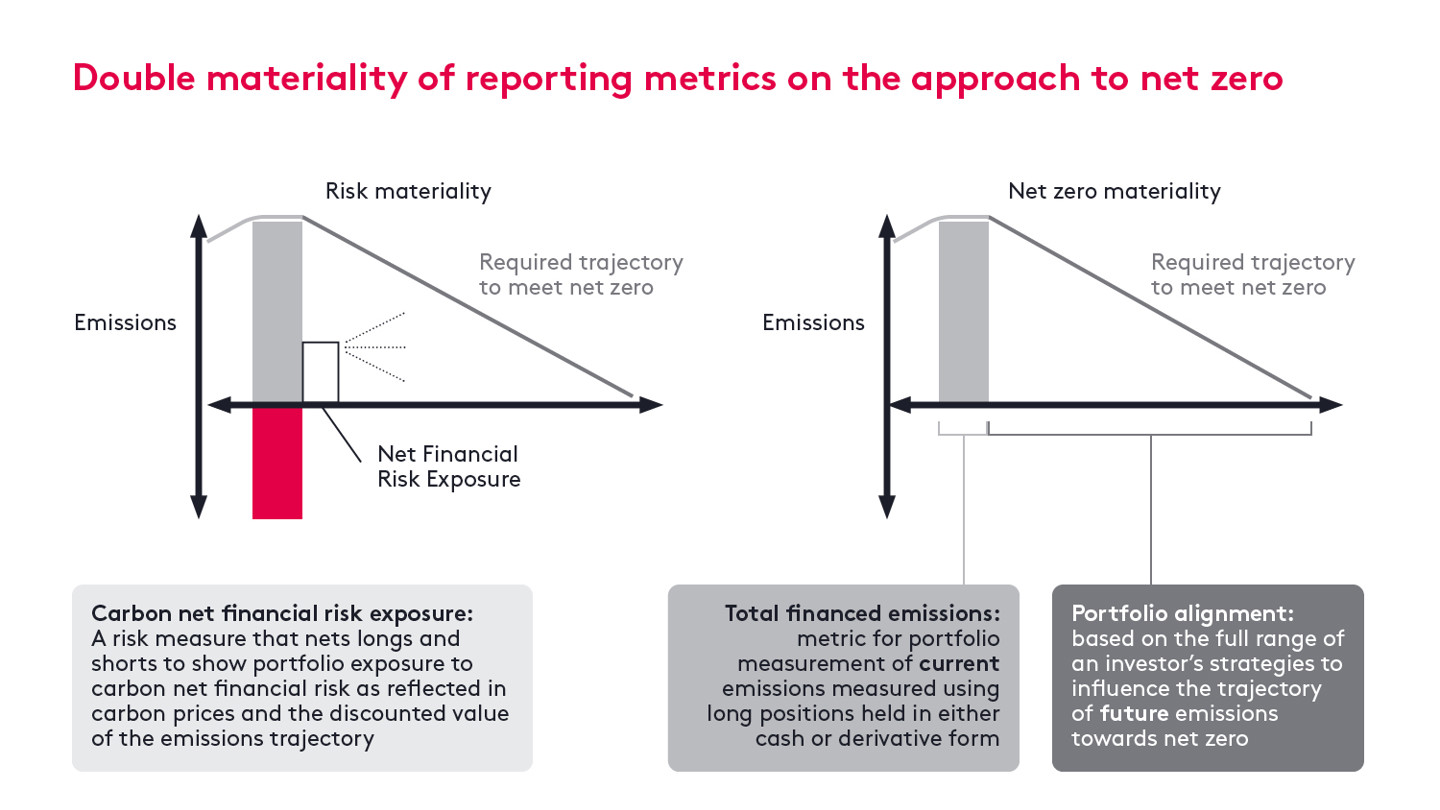

In the area of portfolio measurement and, more specifically, within the definition of financed emissions incorporating derivates, IIGCC proposed to measure and report on carbon emissions separately between long and short positions. Doing so gives clarity to the overall impact of an investor’s strategy and is helpful in showing how (and if) a portfolio is supporting the global economy's transition to a low carbon future, as presented under the net zero materiality option approach in the graph below. The framework does recognise, however, that being long a security also does not cause more emissions to be released into the atmosphere, just as short positions do not remove emissions. Long and short emissions are simply the current emissions associated with the company.

Doing so gives clarity to the overall impact of an investor’s strategy and is helpful in showing how (and if) a portfolio is supporting the global economy's transition to a low carbon future, as presented under the net zero materiality option approach in the graph below. [3]

Meanwhile, netting the emissions in the portfolio reporting could be potentially useful from the perspective of risk hedging (as presented under the risk materiality approach in the graph above). The financial risk exposure could be perceived lower if shorting included stocks that could potentially benefit from the delay in global transition to a low carbon economy and perhaps could become an overarching method of calculation of risk associated with an impact of carbon price into the underlying company's stock price in the future.

It is important to emphasise that reporting should not misrepresent what a long or a short position achieves. The Net Zero Framework makes it very clear that short exposure should not be counted as negative emissions because the purpose of the portfolio GHG measurement is to guide a decline in the emissions intensity of the real economy assets to which the investor is exposed, rather than decline in absolute emission levels only.

The IIGCC's overall recommendations[6] are consistent with the concept of 'double materiality', which sees that any attempt to capture the impact on sustainability should be viewed from the impact on financial performance of the company and the impact that the company has on environmental and social issues in turn.

In practice, the use of the information stemming from portfolio measurement by asset managers has been so far impacted by their strategy. A long-only global fund will be more likely to focus analysis on the transition risk stemming from the world's shift into low carbon. While long-short hedge funds are asking about their relative economic exposure and therefore financial materiality to carbon emissions and in doing so have to consider how to address short versus long investments, with some taking the view that netting shorts from longs should yield a more accurate carbon approach.

However, so far on the regulatory front, there is little guidance for the calculation of the carbon emissions in the portfolios that include shorts, while guidance produced by those such as the Institutional Investors Group on Climate Change suggests a more nuanced approach. In May 2022, the ESG reporting specialist at the European Securities and Markets Authority acknowledged that it’s currently “not entirely clear” within the framework of SFDR how hedge funds should report their short positions. ESMA is reviewing its practical guidance in the area, in response to industry complaints. In the UK, the Financial Conduct Authority has also signalled it would take short selling into account as it builds its own ESG rulebook, the Sustainability Disclosure Requirements. The regulation is likely to apply to asset managers and their UK-based fund products that promote sustainability in their objectives, for now. But the regulator noted the role that short selling can play in contributing to positive sustainability outcomes - for example, by highlighting a negative view of a company’s sustainability risks and, with a sufficient weight of capital, increasing that company’s cost of capital. That same perspective was shared by the Mutual Fund Association's (MFA) paper[7]. MFA examined whether short selling could have an implication for cost of capital in the emissions-intensive stocks (the paper measured the implication for highly emitting sectors only) and concluded that while shorting carbon-heavy stocks would likely have an impact on their cost of capital [8], the price of shares of carbon-heavy industries might remain unchanged.

To summarise, the industry has started to make strides towards more transparent reporting through the concept of portfolio carbon footprinting. However, more work needs to be done to create a consistency of approach in dealing with derivates and long-short portfolios. This is true for the net zero debate, as a fear that long-short funds are able to use a netting approaching to calculate portfolio carbon emissions and thereby being able to report lower emissions than their long-only counterparts. This is also true for any asset manager and asset owner that is required to identify climate-related risks in their operations and investment portfolios. Doing it transparently and in a consistent manner will certainly help in achieving the goal of the Paris Agreement.

It should also be noted that financed emissions is only one of many indicators available to asset managers and it does not describe many other helpful metrics, such as the position of the portfolio in relation to the momentum of carbon emissions; plans to diversify away from GHG-intensive industries; the level of overall pollution associated with the portfolio, etc. The ultimate goal of making carbon calculations more unified and transparent is to allow the real economy to sensibly move towards a more sustainable future.

Ogier continues to support our clients on their journey in managing climate-related risks and opportunities. Contact us today for more information about how we can help.

[1] Standards | Greenhouse Gas Protocol (ghgprotocol.org)

[2] Transition risks are potential financial impacts for businesses that follow from shifts toward a low-carbon future. These risks can include policy and regulatory risks, technological risks, market risks, reputational risks, and legal risks (for more information please visit ESG Align Understanding risk).

[3] Dynamic materiality is a forward looking and adaptive approach to prioritizing issues related to climate change and wider ESG topics (source WEF_Embracing_the_New_Age_of_Materiality.pdf (wlrk.com))

[4] IFSR ramps up activities to support global implementation ahead of issuing inaugural standards end Q2 2023, February 2023

[5] IIGCC "Consultation responses to the IIGCC Derivates Discussion Paper" , August 2022

[6] IIGCC Discussion paper "Incorporating derivates and hedge funds into the Net Zero Investment Framework", August 2022

[7] MFA," The use of short-sells to achieve ESG goals", June 2022.

[8] Study based on 16 heavy emitting companies of the S&P500 Index

Kasia Zatorska

Senior Manager, Sustainable Investment Consulting | Consulting

Hong Kong

Kasia Zatorska

Senior Manager, Sustainable Investment Consulting

Hong Kong

Leonie Kelly

Head of Sustainable Investment Consulting | Consulting

Hong Kong

Leonie Kelly

Head of Sustainable Investment Consulting

Hong Kong

Shirley Lo

Manager, Sustainable Investment Consulting | Consulting

Hong Kong

Shirley Lo

Manager, Sustainable Investment Consulting

Hong Kong

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up

No Content Set

Exception:

Website.Models.ViewModels.Blocks.SiteBlocks.CookiePolicySiteBlockVm