Grace Gao 高诗悦

Senior Associate 高级律师 | Legal

Hong Kong

Grace Gao 高诗悦

Senior Associate 高级律师

Hong Kong

No Content Set

Exception:

Website.Models.ViewModels.Components.General.Banners.BannerComponentVm

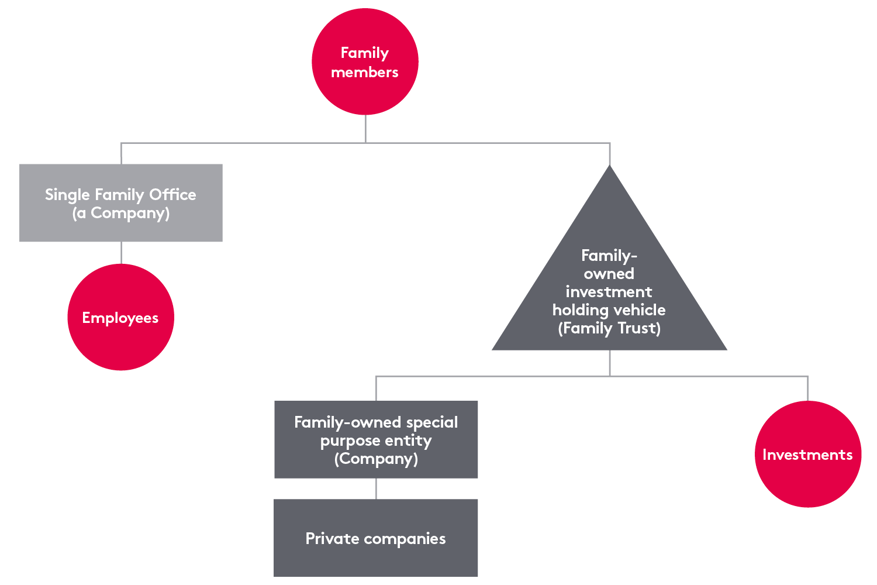

Hong Kong has introduced a new tax regime to attract and retain single family offices in Hong Kong. The new regime provides tax concessions for eligible family-owned investment holding vehicles managed by single family offices in Hong Kong and family-owned special purpose entities since the assessment year starting 1 April 2022.

Profits from qualifying transactions and incidental transactions will be exempted from profits tax in Hong Kong.

The Hong Kong government passed the law instituting the new regime, the Inland Revenue (Amendment) (Tax Concessions for Family-owned Investment Holding Vehicles) Bill 2022, on 10 May 2023.

This article briefly summarises the key elements of the new regime and how families could benefit from it.

There is no legal definition of a family office under the new regime. A family office could be any form of entity or team of people. In practice, for legal, practical and commercial reasons a company is commonly used as a family office. Such company could be a Hong Kong company or an overseas company (such as a BVI, Cayman, Guernsey or Jersey company).

The company (irrespective of where it is incorporated) will need to file tax returns and be subject to profits tax under the general tax rules in Hong Kong if it derives any profit from provision of service to the family.

If a Hong Kong company is used, the register of shareholders and register of directors of the company will be publicly searchable online under Hong Kong company law.

If a non-Hong Kong company is used, whether the names of shareholders and/or directors is publicly available will depend on the specific law and regulation of the country where it is incorporated and/or conducting business.

All family offices are different and provide a mix of different functions and services to the family for which they act. Usually, however, investment management service is the main function of a family office, accompanied by personal, managerial and legal services etc. Employees of the family office are usually professional advisors and may include certain family members.

To qualify under the new Hong Kong tax concession, the single family office must manage the family-owned investment holding vehicle by carrying out investment activities including

At least 75% of the eligible single family office's assessable profits must derive from the services provided to the family, including to

Such income is usually derived from investment management fees from the family-owned investment holding vehicle or service fees from family members.

To qualify under the new Hong Kong tax concession, the family-owned investment holding vehicle must be managed by an eligible single family office.

In order for a single family office to be eligible, the single family (through one or more of its members) must directly or indirectly hold at least 95% of the beneficial interest in the family office.

This percentage could be reduced to 75% of the beneficial interest in the family office if at least 20% of the remaining is held by charities with tax exemption granted under section 88 of the Inland Revenue Ordinance in Hong Kong.

The normal management and control of the family office must be exercised in Hong Kong.

No Hong Kong financial services regulatory licence is required if the single family office only provides services to members of the relevant family. However, if the single family office also provides external services (that is, services to third parties), it may need to apply for necessary licenses from the Securities and Futures Commission of Hong Kong.

For the purpose of enjoying the new tax concession, no application or pre-approval is required from the Hong Kong revenue authorities. A self-declaration that the conditions set out under the regime is sufficient to apply for the tax exemption treatment.

The family-owned investment holding vehicle can be a trust, foundation, company, partnership, established in or outside Hong Kong. An offshore trust qualifies for this purpose. In contrast to a company or a partnership, a trust can potentially have more flexible governance processes as well as additional asset protection and succession planning functions so that it helps minimise the risks of political instability, creditors' claims, matrimonial risks and so on .

To qualify for the Hong Kong tax concession, the single family (through one or more of its members) must directly or indirectly hold at least 95% of the beneficial interest in the family-owned investment holding vehicle (this percentage could be reduced to 75% if at least 20% of the remaining is held by charities with tax exemption granted under section 88 of the Inland Revenue Ordinance in Hong Kong).

The family-owned investment holding vehicle must also be normally managed or controlled in Hong Kong by the single family office, and must carry out its core income generating activities in Hong Kong.

To qualify for the new Hong Kong tax concession, the family-owned investment holding vehicle must have at least two full time employees who

Generally speaking, however, the employees should have the capability and experience to manage the family assets and to undertake any other roles for which they're employed.

The family office will be able to sponsor work visas for non-Hong Kong citizens/permanent residents to take up the required employee roles.

The annual operating expenditure of the family-owned investment holding vehicle must be no less than HK$2 million (approximately US$260,000).

To qualify for the new Hong Kong tax concession, the family-owned investment holding vehicle must meet the minimum assets under management threshold of HK$240 million (approximately US$30 million).

Assets taken into account for calculating the minimum threshold include

The investment does not have to be local in Hong Kong. The family office is free to invest worldwide.

The structure must not have any underlying business for general commercial or industrial purposes.

Ogier has a wealth of experience in working with different types of family office, local and international families and providers of family office services in order to meet the diverse needs of ultra-high-net-worth individuals and their families and to understand the challenges facing them.

We can provide practical assistance in relation to the governance of family offices, including on

We can also provide training to family office administrators to assist with CPD requirements as well as training and guidance to other family office staff and managers and even family members in order to maximise the effectiveness and benefits of the family office.

Grace Gao 高诗悦

Senior Associate 高级律师 | Legal

Hong Kong

Grace Gao 高诗悦

Senior Associate 高级律师

Hong Kong

Marcus Leese

Partner | Legal

Guernsey, Hong Kong

Marcus Leese

Partner

Guernsey, Hong Kong

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up

No Content Set

Exception:

Website.Models.ViewModels.Blocks.SiteBlocks.CookiePolicySiteBlockVm