Catherine Moore

Partner | Legal

Guernsey

Catherine Moore

Partner

Guernsey

No Content Set

Exception:

Website.Models.ViewModels.Components.General.Banners.BannerComponentVm

When most settlors establish a trust, they use a professional trust company as the trustee. This way they can ensure that their trustees are professionals with experience gained being the trustee of many other trusts. However, while this is an ideal way to proceed for many settlors, many jurisdictions can offer the flexibility of using private trust companies.

The purpose of this guide is to demonstrate the advantages and disadvantages of private trust companies (PTCs) and to give a brief overview of PTCs in Jersey, Guernsey, Cayman and the British Virgin Islands.

A PTC is an entity whose sole purpose is to act as trustee in relation to a specific trust or trusts. Such entities do not provide trust services generally, and it will be a condition that they must not solicit business from the public at large. Whilst in almost all cases, the PTC will be a company, since the introduction of the Foundations (Jersey) Law 2009, there is the possibility of using a Jersey foundation as the PTC.

PTCs are valuable in a number of situations, including as trustees of one or more private family trusts, as trustees of commercial trusts and to hold SPVs that are used in financial or other structures.

The most common use of a PTC is to act as trustee of a purpose trust or a discretionary trust which holds shares in a family company. Settlors of such trusts often wish to keep control of the company themselves, and simply desire that the trustees retain such shares. A professional trustee will often be wary of doing so, however, as failure to diversify assets will almost always be a breach of its duty as a trustee as the trustee cannot be said to be acting in the interests of the beneficiaries.

In the past this has been solved by placing express provisions in the trust deed which provides that the trustees shall hold the particular investment and removes all discretion on their part to deal with the investment. Such a provision will only be effective if absolutely unambiguous, and even then the trustees may be left with a residual discretion or the direction may be void for other reasons (for example, public policy).

The PTC may provide the solution.

For a settlor, the key advantage of establishing a PTC is the additional element of control which the PTC can provide. Control is particularly an issue where the settlor is from a jurisdiction unfamiliar with the trust concept, as a settlor is often unwilling to give away control of the assets to strangers in another jurisdiction. The settlor and/or his or her family could be the shareholder or shareholders of a PTC and through that shareholding would be able to appoint and dismiss the directors to the PTC. Whilst this is an obvious disadvantage to the professional administrator, the control of the board of the PTC is often a welcome feature for settlors wishing to retain control. However, if the settlor and/or his family were minded to be shareholders of the PTC, the potential tax consequences of that ownership would need to be fully investigated.

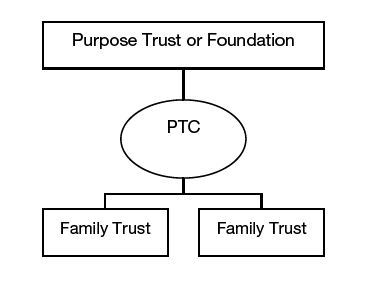

Ownership will generally be recommended to be through a purpose trust or a foundation, rather than the settlor himself. A purpose trust is a trust which is established to achieve a non-charitable purpose, which in the present case is likely to be to provide trusteeship services to designated trusts. This holding structure is illustrated in the diagram below:

On a practical level, a PTC ensures more privacy in relation to the trusts, and allows for rapid commercial decisions to be made. The annual costs are often significantly lower than they would be should a public trust company run the trusts.

The PTC does not compromise the validity of the trust structure and its residency for tax purposes, and can provide immediate and long-term tax planning advantages.

The main disadvantage of a PTC is the cost in establishing a PTC structure. On top of the creation of the trust, a company or foundation must be incorporated. The cost would be further increased if a purpose trust or foundation were used to hold the PTC, as illustrated above, however this could solve potential tax problems. That said, if a foundation were to be a private trustee vehicle itself, there would be no need to have any layer on top, as the foundation would be ownerless. As a result of the cost, PTCs are likely only to be attractive in a commercial context or for very large family structures. For the latter, the costs may be outweighed by the advantages of having a dedicated trustee to look after a complex structure and the control provided to the family.

Different rules apply to PTCs in each jurisdiction. Each is considered in turn:

A Jersey PTC is an incorporated Jersey entity or non-Jersey company whose sole purpose is to provide trust company business in respect of specified trust. A company carrying on trust company business in Jersey is usually required to be licensed and regulated by the Jersey Financial Services Commission (the Commission) under the provisions of the Financial Services (Jersey) Law 1998 (the FSJ Law) paragraph 4 of the Schedule to the Financial Services (Trust Company Business (Exemptions)) (Jersey) Order 2000 (as amended by the Financial Services (Trust Company Business (Exemptions Amendment)) (Jersey) Order 2009) (the Exemptions Order):

“A person being a company-

when providing a service specific in Article 2(4) of the FSJ Law where the name of the company or limited liability company is notified to the Commission.”

The definition of “company” in the FSJ Law is wide enough to include a foundation.

Furthermore, you will note that subparagraph (c) requires the administration of the PTC to be carried out by a body which is registered under the FSJ Law. If this is not complied with then the exemption will not apply.

Certain provisions of the FSJ Law will still apply to PTCs so as to enable to Commission to exercise a supervisory role despite the lack of registration.

The only demand upon a PTC is that its name be notified by letter to the Commission. If the PTC is a Jersey company there is the additional requirement of disclosure to the Commission of the ultimate beneficial owners of the company and information of the trusts of which the company was to be the trustee. If the PTC is incorporated in any other jurisdiction, the rules relating to disclosure of ultimate beneficial ownership would depend on the rules in that other jurisdiction.

The liability of the PTC directors will fall to be assessed in accordance with normal principles, as the duties of the directors are owed to the PTC and not to the underlying trust.

The constitutional documents of the PTC need not mention the names of or refer to the trust(s) which will be involved in the structure.

A Guernsey PTC that provides its services “by way of business” (it charges a fee for acting as trustee) will be carrying on a regulated activity under sections 1(2) and 2(1)(a) of the Regulation of Fiduciaries, Administration Businesses and Company Directors, etc (Bailiwick of Guernsey) Law, 2000 (as amended) (the Fiduciaries Law).

Such a corporate trustee has three possible options.

The granting of an exemption from licensing under the Fiduciaries Law is at the discretion of the GFSC. However, the GFSC’s normal practice in respect of PTCs is to adopt requirements analogous to those set out in the Jersey Exemptions Order applicable to PTCs. Accordingly, so long as the three requirements in the Exemptions Order noted above in the section dealing with Jersey apply (mutatis mutandis) to a particular Guernsey PTC, that PTC would be expected to be able to obtain exemption from licensing under the Fiduciaries Law. Application for exemption carries a small fee.

Provided the GFSC grants the exemption, and the PTC does not engage in any other “regulated activities” (for example “trust administration”) as defined in the Fiduciaries Law then it should not be subject to any further regulation in Guernsey under that law.

The constitutional documents of the PTC need not mention the names of or refer to the trust(s) which will be involved in the structure.

In the Cayman Islands, companies that carry on trust business are regulated by the Banks and Trust Companies Law (2009 Revision). Typically, such companies are required to be licensed by the Cayman Islands Monetary Authority (CIMA), but pursuant the Private Trust Companies Regulations, 2008 (the PTC Regulations) made under that Law there is an exemption for PTCs.

Prior to the PTC Regulations coming into force on 15 September 2008, Cayman PTCs had to hold a restricted trust licence. They also had to make substantial disclosure to, and be subject to vetting and ongoing regulation by, CIMA. In addition, their annual accounts had to be audited. Under the PTC Regulations, these requirements have been removed and replaced by a basic registration requirement.

For the purpose of the PTC Regulations, there are the following three requirements for a company to be a “private trust company”:

“Connected trust business” is defined in the PTC Regulations to mean “trust business in respect of trusts the contributors to the funds of which are all, in relation to each other, connected persons”. Before looking at the meaning of “connected person”, the first observation to be made about this definition is that it looks to the relationship between contributors of the underlying trust assets; it is not concerned with the relationship between the beneficiaries themselves or between the beneficiaries or any contributor.

Suppose a Cayman company is to act as private trustee of a solitary trust. In these circumstances, there should be two contributors who are connected persons: one contributor could be of the person who settles the nominal settled sum, and the other contributor could be the person who settles the substantive property on the trust.

The expression “connected person” is defined broadly. The PTC Regulations provide that person is a connected person in relation to another person if:

Other requirements for Cayman PTC are as follows:

In addition, Cayman’s anti-money laundering regime applies to a Cayman PTC.

The above deals with what is required of a Cayman PTC. What is not required is the following:

The Financial Services (Exemptions) Regulations 2007 (the Regulations) are intended to clarify what is meant by a PTC and simplify the procedure by placing the onus on the registered agent (a trust company holding a Class I license) to determine whether the proposed PTC meets the criteria.

In accordance with the Regulations, in BVI a private trust company is “a company:

The definition of a qualifying business company did not come into effect until 1 January 2008, however, the rest of the Regulations came into effect as of 1 August 2007.

The BVI Companies Act 2004 has been altered in advance to allow the phrase "PTC" to be included in the name of a company engaged in such business.

PTCs are to be exempt where they are unremunerated, and fall within the exemption if they are able to satisfy the definition in Part I, section 2 of the Schedule:

“(1) Trust business carried on by a private trust company is unremunerated trust business if no remuneration is payable to, or received by, the private trust company, or any person associated with the private trust company, in consideration for, or with respect to, the services that constitute the trust business.

(2) For the purposes of subparagraph (1), “remuneration” includes money or any other form of property; and it is immaterial whether remuneration is payable or received out of the assets, or underlying assets, of a relevant trust; from the settlor or beneficiary of a relevant trust; or from any other person pursuant to an arrangement with the settlor or beneficiary of a relevant trust.”

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up

No Content Set

Exception:

Website.Models.ViewModels.Blocks.SiteBlocks.CookiePolicySiteBlockVm