Jennifer Fox

Partner | Legal

Cayman Islands

Jennifer Fox

Partner

Cayman Islands

In 2018 the Cayman Islands Court of Appeal unanimously allowed every ground of an appeal by the liquidators of Argyle Funds SPC Inc. ("Argyle"), holding that its former auditors, BDO Cayman Ltd ("BDO Cayman"), had no sustainable basis for restraining Argyle from continuing claims of fraud and gross negligence against three of BDO Cayman's affiliate entities in the New York courts. This decision is therefore of particular interest to Cayman Islands professional service providers who delegate some or all of their work to be undertaken outside of the jurisdiction.

The Court of Appeal's decision in Argyle Funds SPC Inc. (In Official Liquidation) v BDO Cayman Ltd1, delivered on 8 October 2018, overturned an anti-suit injunction ordered by Mr Justice Raj Parker in the Grand Court of the Cayman Islands (the "Grand Court") earlier in the year preventing Argyle from bringing proceedings against BDO Trinity Limited, BDO USA LLP and Schwartz & Co LLP (together, the "Affiliates") in New York for their alleged failure to alert Argyle in the course of four audits between 2010 and 2013 to two catastrophic frauds which resulted in Argyle's collapse (the "New York proceedings"). Argyle claimed compensatory damages of over US$86 million and punitive damages of not less than US$260 million.

The most important points arising from the Court of Appeal's judgment are:

Background

Facts

Argyle was a Cayman Islands Mutual Fund with BDO Cayman as its statutory auditor for the audit years ending 31 December 2006 – 2014, as a result of which audits of the investments held by certain of Argyle’s classes should have been scrutinised with appropriate care. Argyle and BDO Cayman entered into four audit engagement letters between 2010 and 2013 (the "Engagement Letters"), however the Affiliates were not parties to the Engagement Letters.

In 2016, Argyle discovered that large sums under the control of one of the credit advisors in which it had invested (and which had purportedly been audited) had been misappropriated through the fraudulent actions of that credit advisor. On 31 May 2016 Argyle went into official liquidation.

On 21 June 2017 Argyle commenced the New York proceedings against BDO Cayman and the Affiliates.

First instance proceedings in the Grand Court

On 8 August 2017, BDO Cayman filed an ex parte Originating Summons on notice to Argyle in the Grand Court of the Cayman Islands seeking an anti-suit injunction against Argyle to restrain it from continuing the New York proceedings against BDO Cayman and the Affiliates.

BDO Cayman claimed that the following five key clauses constituted a contractual scheme under which Argyle was obliged to have any dispute arising out of an audit governed by the Engagement Letters determined by arbitration in the Cayman Islands and solely against BDO Cayman:

(i) Applicable Law;

(ii) Exclusive Jurisdiction

(iii) Dispute Resolution

(iv) Assignment; and

(v) Sole Recourse4.

BDO Cayman further argued that Argyle could only claim against the Affiliates with respect to allegations of fraud, wilful default and non-excludable liability if an exception contained in the Sole Recourse clause applied and that, even if an exception applied, such a claim had to be brought in the Cayman Islands under the Exclusive Jurisdiction clause.

In relation to the 2010 audit (governed by the 2010 Engagement Letter which did not contain the Sole Recourse Clause), BDO Cayman's case relied on the Dispute Resolution and Assignment clauses, together with the contention that if those clauses did not prohibit Court proceedings against the Affiliates, those proceedings must be brought in the Cayman Islands under the Exclusive Jurisdiction Clause.

Argyle argued that, on a proper construction of the five key clauses, there was no bar to the claims against the Affiliates. In respect of the 2010 audit, Argyle argued that the Assignment Clause was not engaged because BDO Cayman had not filed any evidence of an assignment or established that the Affiliates were "permitted assignees". Further, a covenant not to sue the Affiliates could not be spelled out of the Assignment Clause. Finally, in respect of the 2011, 2012 and 2013 audits, the claims in the New York proceedings against the Affiliates fell squarely within the exception in the Sole Recourse clause.

In granting the anti-suit injunction, Justice Parker ruled that: (i) the New York proceedings breached the Arbitration, Exclusive Jurisdiction and Sole Recourse clauses, and the forum in which Argyle was required to pursue any claims arising under or in relation to the Engagement Letters was by arbitration against BDO Cayman alone, even where a third party assisted with the audits; and (ii) BDO Cayman remained solely liable for its own performance and that of its assignees, and Argyle agreed not to bring claims or proceedings against any assignee. Justice Parker rejected Argyle's submission that the clauses had no application because Argyle's claims in the New York proceedings fell within the exception to the Sole Recourse clause and were founded on an allegation of fraud, wilful misconduct or other liability which cannot be excluded under New York law. Justice Parker held that, for the exclusion to apply, the pleaded claims in the foreign proceedings should comply with Cayman Islands pleading standards and made various findings of fact relying upon and preferring the untested affidavit evidence of BDO Cayman.

The Appeal

The five key clauses were also considered by the Court of Appeal as they applied to each of the Engagement Letters.

The 2010 audit

The Court of Appeal agreed with Argyle that Justice Parker had erred in his finding that the claims against the Affiliates in respect of the 2010 audit were in breach of the 2010 Engagement Letter (which did not contain the Sole Recourse Clause).

The Court of Appeal held that it was for BDO Cayman to establish that, under the Assignment Clause, Argyle was contractually obliged to litigate any claim against the Affiliates pursuant to the Dispute Resolution clause or that otherwise Argyle had entered into an enforceable covenant not to sue the Affiliates. However, BDO Cayman had produced no evidence at all that the Affiliates were a 'permissible assignee' of that they had agreed to be bound by the "applicable terms and conditions of the [Engagement Letter]", which was required on the true construction of that clause.

Further, the claims in respect of the 2010 audit were found not to be governed by the Exclusive Jurisdiction clause. The Court of Appeal held that, if claims against third parties were to fall within the clause, clear wording to that effect would be necessary and there would also be an imbalance caused by the absence of any machinery ensuring that the third party was subject to the jurisdiction of the Cayman Islands' Courts.

The 2011, 2012 and 2013 audits

The Court of Appeal concluded that there were two central issues:

In answer the first issue, the Court held that the claims in wilful misconduct and fraud against the Affiliates fell within the exception. It was not a function of the Grand Court to decide whether the allegations in New York complied with the pleading requirements in England or Cayman (which, it appeared to the Court of Appeal, is what Justice Parker had concluded). Argyle's evidence from New York legal counsel showed that the claims complied with New York law and there was no admissible evidence to the contrary.

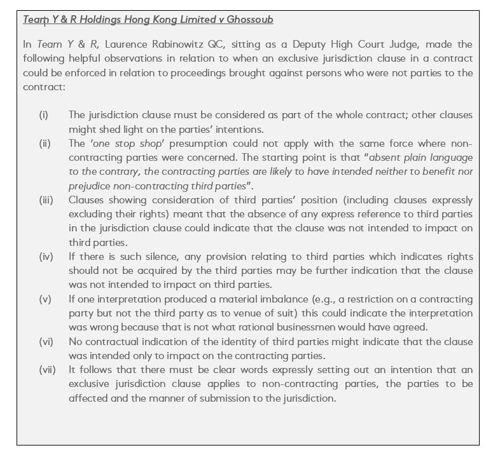

In answer to the second issue, the Court of Appeal held that to answer the question, the Grand Court is to adopt the seven steps articulated in Team Y & R Holdings (see below). In so doing the Court of Appeal found that the Exclusive Jurisdiction clause did not extend to claims brought by Argyle against third parties pursuant to the exception in the Sole Recourse clause. The intended effect of the exception was that Argyle should be free to bring all claims that fell within the exception in judicial rather than arbitral proceedings. Argyle was not bound to arbitrate its claims against the Affiliates as the Court of Appeal confirmed that the Dispute Resolution clause only applied to parties to the Engagement Letters. If the parties had intended that the Exclusive Jurisdiction clause apply to such claims, express words within that clause were needed. The Court of Appeal rejected BDO Cayman's argument that in agreeing to the Exclusive Jurisdiction clause, Argyle took the risk that a third party sued under the exception would not be subject to the jurisdiction of the Cayman Islands.

Procedural point

Although it was not necessary for the Court of Appeal to rule on this point, the judgment clarifies the position in the Cayman Islands in relation to the Court's jurisdiction to issue injunctions.

At first instance Argyle argued that the Grand Court lacked jurisdiction to grant an injunction against Argyle because it had not been made a party to the Originating Summons proceedings. Justice Parker rejected Argyle's argument, finding that the Grand Court had jurisdiction to grant the anti-suit injunction order in personam. His Lordship concluded that there had been no material non-compliance with the Grand Court Rules or prejudice to Argyle resulting from the procedure adopted despite the fact that Argyle was prevented from obtaining disclosure of the documents referred to in BDO Cayman's pleadings and evidence. Were it necessary to do so, Justice Parker said that he would have allowed the defect to be cured under GCR Order 2 Rule 1, applying the Overriding Objective.

The Court of Appeal disagreed with BDO Cayman's argument that it was necessary to make Argyle a party and found that Argyle should have been made a party to the proceedings prior to the hearing at first instance. However, the Court of Appeal decided not to make BDO Cayman a party as it was now unnecessary to do so given its decision to allow Argyle's appeal.

Conclusion

The judgment is significant as a clear statement of the rights of those receiving professional services to pursue the parties that actually perform those services in the appropriate forum unless there is express and unambiguous language preventing such claims.

The key takeaway for the professional services industry in the Cayman Islands is that where work is delegated to be carried out by related entities outside of the Cayman Islands, any attempt to contractually limit clients' rights to bring claims against those entities must be expressly articulated within the contract. Failure to do so or to do so with ambiguity risks rendering nugatory the very limitations originally sought.

The clarity provided by this decision is especially helpful in light of the possible adverse cost consequences arising out of proceedings filed improperly in breach of an exclusive jurisdiction clause and further defending a consequential anti-suit injunction. In the 2019 costs decision of Riad Tawfiq Al Sadik v Investcorp Bank B.S.C.& Ors (FSD 47 of 2009), the party applying for the anti-suit injunction recovered its costs of both the wrongfully commenced action and antisuit injunction proceedings on the indemnity basis. This should encourage parties to consider carefully any contractual dispute resolution provisions before deciding where to commence proceedings.

Ogier Partner Jennifer Fox acted on behalf of Argyle Funds SPC Inc.

1 The Sole Recourse Clause was only contained in the 2011, 2012 and 2013 Engagement Letters.

2 [2017] EWHC 2401

3 [2009] 1 Lloyd’s Law Rep 59

4 CICA 8 of 2018

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up