Kate Hodson 凯特·赫臣

Partner and Head of ESG (Legal) 合伙人 | Legal

Hong Kong

Kate Hodson 凯特·赫臣

Partner and Head of ESG (Legal) 合伙人

Hong Kong

No Content Set

Exception:

Website.Models.ViewModels.Components.General.Banners.BannerComponentVm

As ESG momentum continues to grow, so does the complex regulatory landscape for asset managers. The combination of mandatory climate-related disclosures and an EU-wide SFDR "disclosure exercise" is inevitably moving the market forward, while the "E" in ESG continues to hold its strong position. As the market starts to build ESG capacity and becomes more fluent in the transparency rules, the ESG integration in asset management is only going to deepen in the years to come, Kate Hodson, head of ESG Legal, explains.

Investors and regulators have shown increasing interest in ESG over the past few years. In 2021 alone at least 34 regulatory bodies and standard setters in 12 markets undertook official consultations on ESG[1]. Many jurisdictions, including the UK, the EU, Singapore and Hong Kong have announced regulation that requires asset managers to consider climate-related risks in their ongoing portfolio analysis, where relevant and material, and to enhance the reporting of such information to investors. The US Securities and Exchange Commission (SEC), has just unveiled new proposals requiring US-listed companies to disclose a range of climate-related risks and greenhouse gas emissions from their own operations, as well as from the energy they consume, and to obtain independent certification of their estimates. We are expecting the SEC to also announce updated rules for the asset managers this year, as part of the wider consultation work undertaken in late 2021. Since ESG regulatory landscape is proving intricate and evolving rapidly, asset managers must navigate the technical requirements and ensure they are ready for such regulations. The trend is placing ESG firmly into firms' regular disclosure agenda and practises.

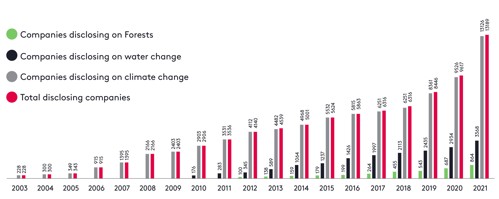

Number of companies reporting under CDP, 2003-2021

Source: Companies scores - CDP, 2021

Climate-related risk considerations have so far received substantially more focus from regulators compared to social aspects. On one hand, this is surprising given that many social considerations underpin companies' fundamental pillars of operation such employees, suppliers and customers. But on the other hand, more research work is required to explicitly link financial performance of publicly listed companies to the social aspects of ESG analysis. Severe social allegations raised against well-performing stocks are not yet likely to convince many asset managers to immediately divest. Instead, more measurable factors, such as physical risk and transition risk from climate change continue to trigger red flags in managers' portfolios.

The Covid-19 pandemic has no doubt highlighted the interconnectivity of society and environment, the importance of employees and issues related to working conditions, and has brought to light asymmetries in supply chains. This, in turn, has sharpened the lens towards issues such as reduction in wages and benefits, and denial of severance pay. However, broader themes such as the tight labour market, raising inflation and concern over the exploitation of minorities have become key social concerns in 2022.

From the regulator's perspective there is a growing international momentum towards mandatory due diligence for human and labour rights in supply chain. The European Commission recently adopted a proposal for a Directive on corporate sustainability due diligence, under the EU's Sustainable Corporate Governance Initiative. The proposal aims to foster sustainable and responsible corporate behaviour throughout global value chains to mitigate adverse impacts of corporate activities on human rights, such as child labour and exploitation of workers, and on the environment, for example pollution and biodiversity loss.

The Global Reporting Initiative’s (GRI) new sustainability reporting standards, released in late 2021 also aim to enhance human rights-related information. This most comprehensive to date revision of the GRI reporting standard will be effective as of January 2023 and will support disclosures in line with major intergovernmental frameworks relating to human rights and sustainability due diligence, including the UN Guiding Principles on Business and Human Rights, OECD Guidelines for Multinational Enterprises, OECD Due Diligence Guidance for Responsible Business Conduct, ILO International Labor standards and ICGN Global Governance Principles.

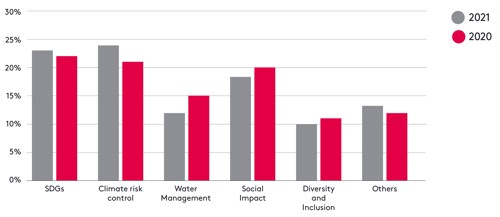

Key investment themes for asset managers in 2020 and 2021

Source: Russell Investments Annual ESG asset managers survey, 2021

It is important to make a distinction between investments seeking to manage social factors as part of their ESG risk strategy versus a socially-themed fund, for example, that specifically seeks to affect change for a specific impact outcome. The former may address and manage social factors through social values and good governance practice and norms, with the aim being to limit exposure to high-risk companies and controversy-prone outliers. Social impact funds may seek to address a specific theme such as social injustice and to create measurable change for the benefit of society at large.

Increased demand for investment products that specifically address the "E", "S" or "G" point to a broad spectrum of needs, with various themes emerging across geographies. Asian retail investors have placed greater emphasis on social and governance factors over environmental issues, according to the 2021 Global ESG investor study by Global AXA Group's multi-manager, Architas. This study suggested that Architas’s clients want to see their managers engaging on ethical issues, health and safety and to promote access to quality education, unlike their European counterparts whom place more focus on climate change, ocean and marine conservation and avoidance of water waste[2].

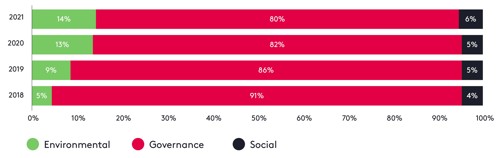

Similarly, a survey carried out by the Swiss Finance Institute[3] in 2019 found that investors deem governance and social risks more important than climate and environmental issues; however, the latter has come more into the limelight due to regulation. By 2021, asset managers had started to consider incorporation of ESG from a wide range of metrics, according to Russell Investments 2021 ESG Manager Survey. From a total of 369 asset managers who participated in the survey, the majority of respondents pointed out to the broadening of ESG-related factors in their decision-making. Moreover, 75% of the respondents claim to incorporate specific ESG considerations when the materiality is high - this is up from 63% in 2020. And, despite the fact that governance remains the dominant factor (see graph below), other industry specific ESG elements are raising in materiality and therefore consideration.

Key ESG factor impacting investment decisions for asset managers

Source: Russell Investments Annual ESG asset managers survey 2021

Sustainability-related frameworks, such as the Principles for Responsible Investment (PRI) and the Task Force on Climate-related Financial Disclosure (TCFD) and International Organization of Securities Commissions (IOSCO), have continued to shape asset managers' integration of ESG in recent years. Such institutions have supported the market through the issuance of practical guidelines and frameworks, issuing and commissioning research and helping to promote consistent disclosure standards.

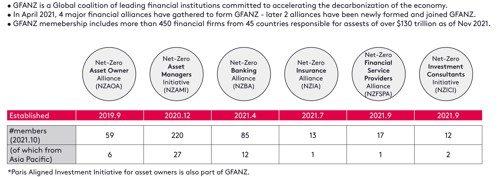

Other prevalent initiatives, including the CDP (formerly the Carbon Disclosure Project) and Climate Action 100+, have supported market development by supporting institutional investors vis-a-vis engagement and stewardship practices. The net zero finance initiatives have also gained traction. For example, the recently created Glasgow Financial Alliance for Net Zero (GFANZ)[4] is seeking to unify and broaden net-zero ambitions across the financial system and demonstrate firms’ collective commitments to supporting companies and countries in achieving the goals of the Paris Agreement. As of November 2021, GFAZN spans 450 firms across 45 countries, marking over US$130 trillion of private capital towards transforming the economy to net zero.

Glasgow Financial Alliance for Net Zero structure

Source: GFANZ, 2021

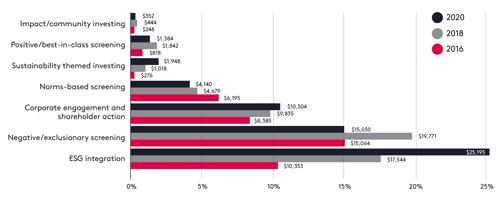

ESG integration strategies are gaining traction. According to the Global Sustainable Investment Alliance, multi-factor ESG integration was the most common sustainable investment strategy globally, followed by negative screening, corporate engagement and shareholder action, norms based screening and sustainable themed investments.[5]

Key ESG strategies in asset management by percentage and fix source to GSIA, 2020

Source: GSIR 2020

This is encouraging and shows that ESG integration will potentially become widespread of AUM and asset classes. It also gives hope that ESG will move beyond simply stating a policy and goals towards deeper integration and implementation. The combination of mandatory climate-related disclosures and EU-wide SFDR "disclosure exercise" is moving the market forward. In relation to the EU SFDR requirements, the transition phase in 2021/22 is proving quite a technical exercise for asset managers. However, as the market starts to build ESG capacity and becomes more ESG-fluent with regulatory requirements, the market will naturally progress forward. What is clear today is that the market is very much trying to find its feet and to use this transition period as a learning exercise for asset managers to digest countless data sets, understand ESG screening tools and measurement methodologies in order to gauge portfolio level exposure to material and relevant risks. Beyond regulation, managers are also increasingly seeing increased pressure from investors to monitor, manage and disclose on ESG.

According to recently released data from Morningstar[6], sustainable fund flows slowed down in the fourth quarter of 2021, hitting US$14 billion, compared with US$22 billion in Q1 2021. On average, however, sustainable funds net flow was much higher than in 2020, leading to another record-setting year. ESG has seen growing momentum not only across traditional asset management but also across private equity, real estate and hedge funds.

It is important to note that as the ESG growth momentum continues, the market will see further deepening and perhaps additional adjustment. In February 2022, Morningstar Inc reclassified some 1,200 funds away from its sustainability tag, making it harder for asset managers to obtain what has proven to be a desirable title.

Further regulation, more wide-spread understanding of different sustainability-led investment strategies and stricter market analysis will almost certainly lead to a further adjustment in the number of "green" and "ESG" funds in the market. But one thing can be certain, and that is the fact that ESG integration in asset management is only going to deepen further in the years to come.

[1] Regulation at a Crossroads: Convergence or Fragmentation? - MSCI

[2] Did you know? (architas.com)

[3] Swiss Finance Institute Research Paper Series N°18-58 'The Importance of Climate Risks for Institutional Investors'

[4] GSIR-20201.pdf (gsi-alliance.org)

[6] Sustainable Fund Flows Dip for the Quarter but Peak for the Year | Morningstar

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients. We regularly win awards for the quality of our client service, our work and our people.

This client briefing has been prepared for clients and professional associates of Ogier. The information and expressions of opinion which it contains are not intended to be a comprehensive study or to provide legal advice and should not be treated as a substitute for specific advice concerning individual situations.

Regulatory information can be found under Legal Notice

Sign up to receive updates and newsletters from us.

Sign up

No Content Set

Exception:

Website.Models.ViewModels.Blocks.SiteBlocks.CookiePolicySiteBlockVm